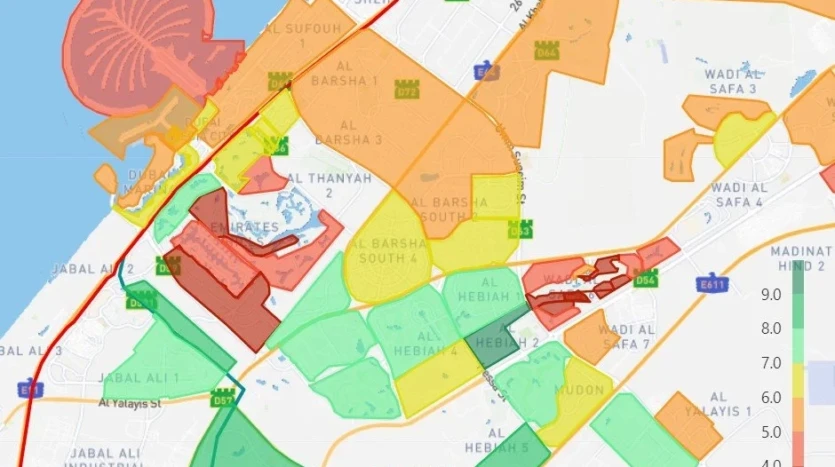

Top 10 Dubai Communities with the Highest Investment Yields in 2025

Summary

Which Dubai communities are delivering the best rental returns in 2025? We analyzed Property Monitor’s September 2025 data to rank the top-performing areas by average gross investment yield. This guide highlights where investors are seeing the strongest returns, how yields have changed over the past year, and what these numbers mean in practical terms. Data source: Property Monitor.

Understanding Investment Yields

For property investors, yield is a key measure of how well an investment is performing. It represents the annual rental income compared with the property’s purchase price, expressed as a percentage. A higher yield generally indicates stronger cash flow, but smart investors also consider capital appreciation, tenant demand, and maintenance costs when assessing opportunities.

Using Property Monitor’s September 2025 community index, we ranked Dubai’s communities by their average gross investment yield. We also looked at how each area’s yield has moved compared with the same time last year, giving you a clear view of where returns are rising or stabilizing.

Get a free ROI analysis on your preferred community.

Dubai’s Top 10 Communities by Average Gross Investment Yield

| Rank | Community | Current Average Gross Yield | Change vs Last 12 Months |

|---|---|---|---|

| 1 | Emirates Hills | 12.67% | Up 570% |

| 2 | Al Khail Heights | 8.88% | Up 5.3% |

| 3 | Dubai Investments Park (Apartments) | 8.70% | Down 12.8% |

| 4 | International City | 8.61% | Down 5.3% |

| 5 | Dubai Sports City (Apartments) | 8.17% | Down 6.5% |

| 6 | DAMAC Hills 2 (Apartments) | 8.09% | Down 6.0% |

| 7 | Dubai Studio City | 8.00% | Down 11.9% |

| 8 | Liwan | 7.92% | Down 9.2% |

| 9 | Al Barari | 7.82% | Up 26.1% |

| 10 | Discovery Gardens | 7.72% | Down 6.9% |

Source: Property Monitor, September 2025.

Key Insights from the 2025 Ranking

Luxury communities show surprising jumps

Emirates Hills leads the list with a striking 12.67 percent yield, driven by a noticeable rise compared to the previous year. Such sharp movements in luxury areas often reflect shifts in rental pricing or a change in the types of transactions recorded. While high-end properties can offer attractive returns, buyers should verify rental comparables before assuming the trend will continue.

Mid-market communities remain the backbone of steady income

Several popular apartment clusters such as Dubai Investments Park, International City, and Dubai Sports City continue to offer solid yields between 8 and 9 percent. These areas are favored by investors looking for dependable tenants and consistent rental cash flow. Their balance of affordability and demand makes them ideal for first-time or portfolio investors seeking stable performance.

Yields move, not just the market

Most of the top-yielding areas have seen small adjustments compared with last year. A few, like Al Barari, recorded gains, while others dipped slightly. Monitoring these changes helps investors understand whether returns are trending up or normalizing after an exceptional rental period.

Each community suits a different strategy

If your goal is consistent rent and quick occupancy, consider the mid-range zones such as International City or Liwan. Those who prefer larger family tenants and longer leases might find Dubai Sports City or DAMAC Hills 2 a better fit. Investors chasing capital appreciation while maintaining good rental yield can explore select premium neighborhoods like Al Barari.

How to Use This Information

1. Shortlist communities that match your investment goals

For rental income, look at the established apartment hubs. For longer-term value growth, review upscale or emerging areas showing improving yields.

2. Request a personalized ROI analysis

Every building and unit type performs differently. We offer a free ROI analysis to help you understand the real picture. You will see projected cash flow, payback period, and return potential based on your preferred community.

3. Validate rent and price data locally

Ask for recent lease agreements or agent-verified rent examples. The averages listed here serve as a reference, but your actual unit could perform above or below the community mean depending on location, view, and size.

4. Set a clear target yield when negotiating

Whether you are buying ready or off-plan, use your desired yield as part of your pricing strategy. It keeps your investment grounded in financial logic, not emotion.

Examples of Investor Profiles

Entry-level investor

Buyers with budgets between AED 700,000 and 1.4 million often focus on Discovery Gardens or Liwan. These locations offer strong occupancy and manageable costs, typically yielding around 7.5 to 8 percent per year.

Mid-range investor

With a budget between AED 1 million and 2 million, Dubai Sports City and DAMAC Hills 2 stand out. They deliver healthy yields near 8 percent and attract family tenants who prefer two or three-bedroom units.

Premium investor

High-net-worth buyers targeting AED 6 million and above might consider Emirates Hills or Al Barari. While the headline yields are high, due diligence is essential to confirm rental demand and ongoing maintenance expenses.

Points to Keep in Mind

- Averages can hide wide variations within each community. Always assess the yield for your specific property type.

- Gross yield does not account for service charges, management fees, or maintenance. These can lower your actual net return by one to two percentage points.

- Communities with fewer transactions may show sudden yield changes. Verify data with current market evidence before committing to purchase.

Conclusion

Dubai’s property market in 2025 continues to reward investors who focus on research and data. Communities with yields between 7 and 9 percent remain the most balanced choices for long-term rental returns. Luxury districts have shown eye-catching jumps, but careful verification is vital. Whether you are buying your first investment or expanding a portfolio, knowing where yields stand helps you make smarter moves.

Get a free ROI analysis on your preferred community.

Data source: Property Monitor, Dubai Community Indices, September 2025.

FAQs

What is a good rental yield in Dubai?

Most investors consider a gross yield between 7 and 9 percent to be healthy. It provides solid rental income while still allowing room for property appreciation.

Is a higher yield always better?

Not necessarily. A high yield can sometimes indicate a lower property price or temporary rent spikes. It is best to check tenant demand, service charges, and resale potential before relying only on yield numbers.

How often should I review my investment yield?

Checking performance every quarter helps you track changes in rental demand and price movement. Markets can shift quickly, so staying updated allows timely decisions.

Do gross yields include maintenance and service charges?

No, gross yields represent rental income divided by purchase price before expenses. To understand your real return, calculate net yield after all running costs.

How can I know which community suits my investment goals?

The right area depends on your target tenant and budget. Mid-market communities often provide steady rent, while premium areas offer stronger growth potential. A custom ROI analysis can help you decide.